will my credit score go up if i finance a car

Why did my credit score drop when I financed a car. If you want to buy a house and your credit score is 400 you wont get approved for most mortgages.

Can I Finance A Car With No Credit Stingray Chevrolet

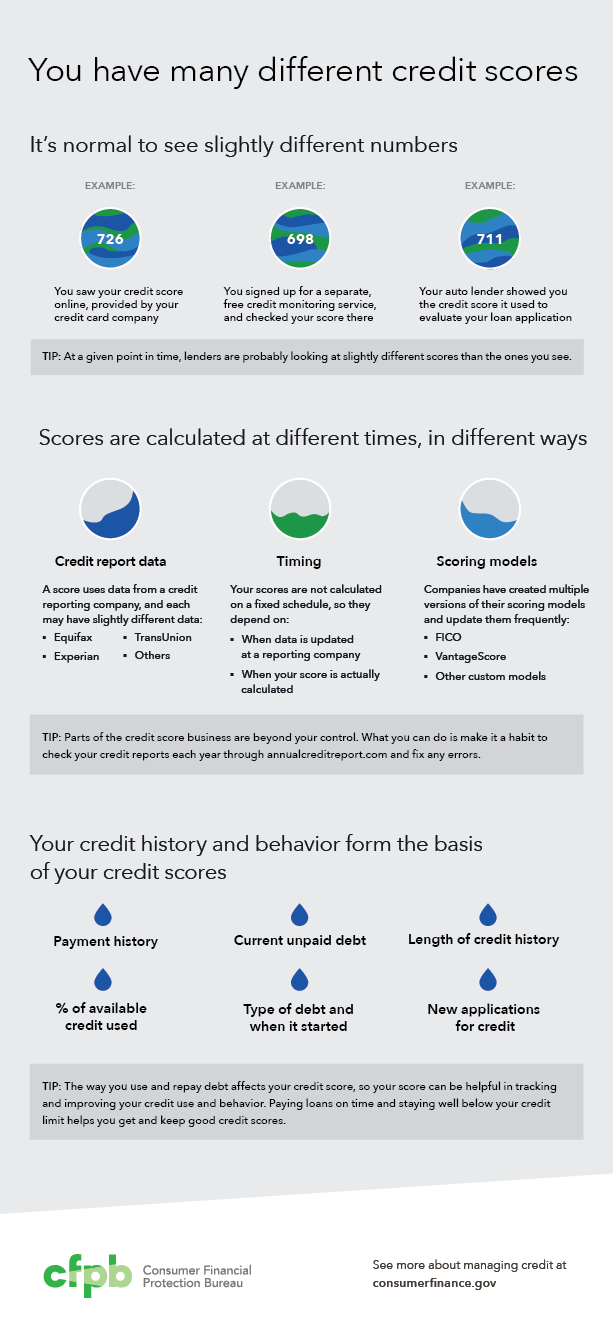

Credit scores are highly sensitive to your credit.

. With fixed-rate conventional loans. When you apply for car loans your score actually drops five to 10 points due. If your car loan is your oldest account your credit score will decrease when you pay it off.

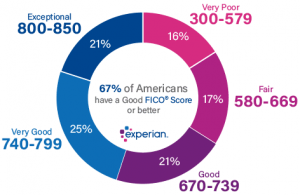

Your score in general will not be drastically changed. Although ranges vary depending on the credit scoring model generally credit scores from 580 to 669 are considered fair. For instance to get an FHA loan you need to have a credit score of at least.

Answer 1 of 6. As we said active credit has a better impact on your credit score than past closed accounts. Finance is the study and discipline of money currency and capital assetsIt is related to but not synonymous with economics the study of production distribution and consumption of money.

On the other hand TransUnion previously known as CallCredit has a. For most people a credit points rise of 100 in one month is extremely unlikely. Patience is a virtue and thats just what youll need to see your credit score improve from a car loan.

Keep doing the right things making payments on time registering. Your score dropped after buying a car due to hard inquiries. However the lender can continue to charge interest and report the loan as paid late.

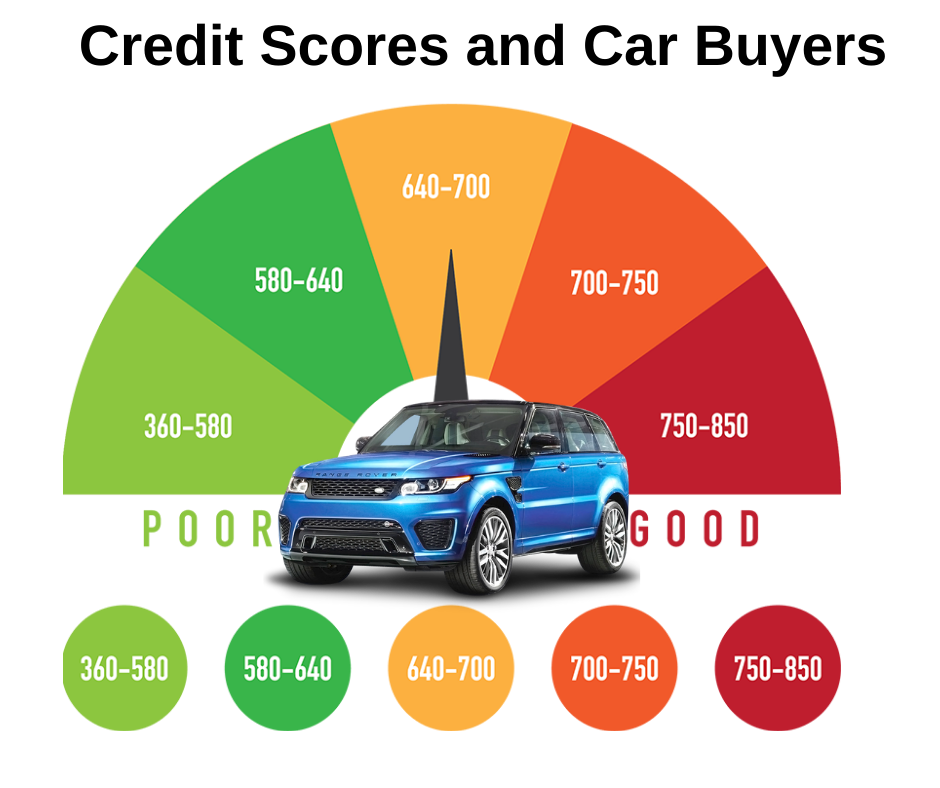

My credit score before paying off. FICO credit scores the industry standard for sizing up credit risk range from 300 to a perfect 850with 670 to 739 labeled good 740-799 very good and 800 to 850. Around 50 points at worst.

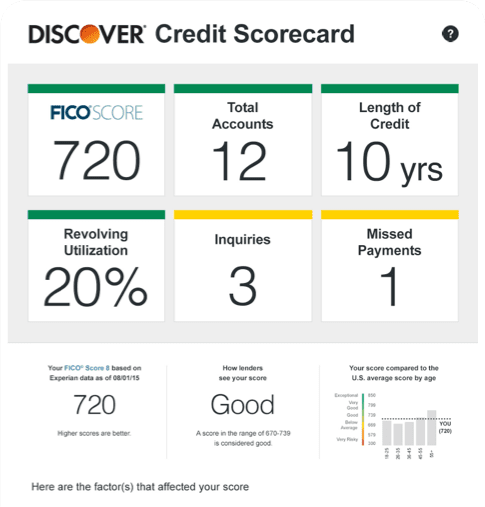

Car Loan and Credit Utilization An auto loan will not have an affect on your credit utilization score. If you have a credit score of 720 or higher and a down payment of 25 or more you dont need any cash reserves and your DTI ratio can be as. Your score will increase as it satisfies all of the factors the.

The good news is financing a car will build credit. Does financing a car affect credit score. It depends on several contributing.

Does car finance affect your credit score. Thats because youre reducing your length of credit history. Yes it is possible to have a credit score of at least 700 with a collections remark on your credit report however it is not a common situation.

Its best to play the long game and be patient. As you make on-time loan payments an auto loan will improve your credit score. At Easy Auto Lenders you pick the terms and we handle the.

However while your credit score may go down for a little while after you complete. Generally speaking your credit score can see changes every 30-45 days. For a score with a range between 300 and 850 a credit score of 700 or above is generally considered good.

The good news is financing a car will build credit. Why is my credit score going down if I pay everything on time. FICO credit scores the industry standard for sizing up credit risk range from 300 to a perfect 850with 670 to 739 labeled good 740-799 very good and 800 to 850.

Each credit report the auto loan lender pull adds 1 new. Theres a missed payment lurking on your report A single payment that is 30 days late or more can send your. Generally speaking when you pay off a car loan or lease your credit score will take a mild hit.

In short while the general result of a paid-off car loan is a small drop in credit score theres no one-size-fits-all rule and you wont know the exact impact of paying off your car. Were often asked if car finance will have an impact on a persons credit score and occasionally if car finance will actually improve someones. How long does it take for my credit score to go up after paying off my credit cards.

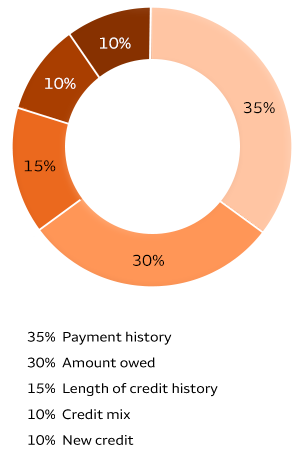

Your payment history is actually the factor that has the biggest impact on your FICO credit score accounting for 35 of it and is based on whether youre making payments. 740 to 799 are considered very good. 670 to 739 are considered good.

For instance Equifaxs scoring system allows for a score between 0-700 with the UK average being around 380.

Free Credit Score Fico Credit Score Card Discover

What Is A Credit Score What Are Credit Score Ranges Nerdwallet

Can I Get A Car Loan With A 600 Credit Score Experian

How Long After Paying Off Debt Will Your Credit Score Improve Student Loan Hero

:max_bytes(150000):strip_icc()/how-long-it-takes-to-build-good-credit-4767654_final-5b370f861f4f42e5975e63c6bbeb2784.gif)

How Long It Takes To Build Good Credit

What Makes Your Credit Score Go Up And Down

How To Get A Bad Credit Car Loan Mtn View Chevrolet Chattanooga

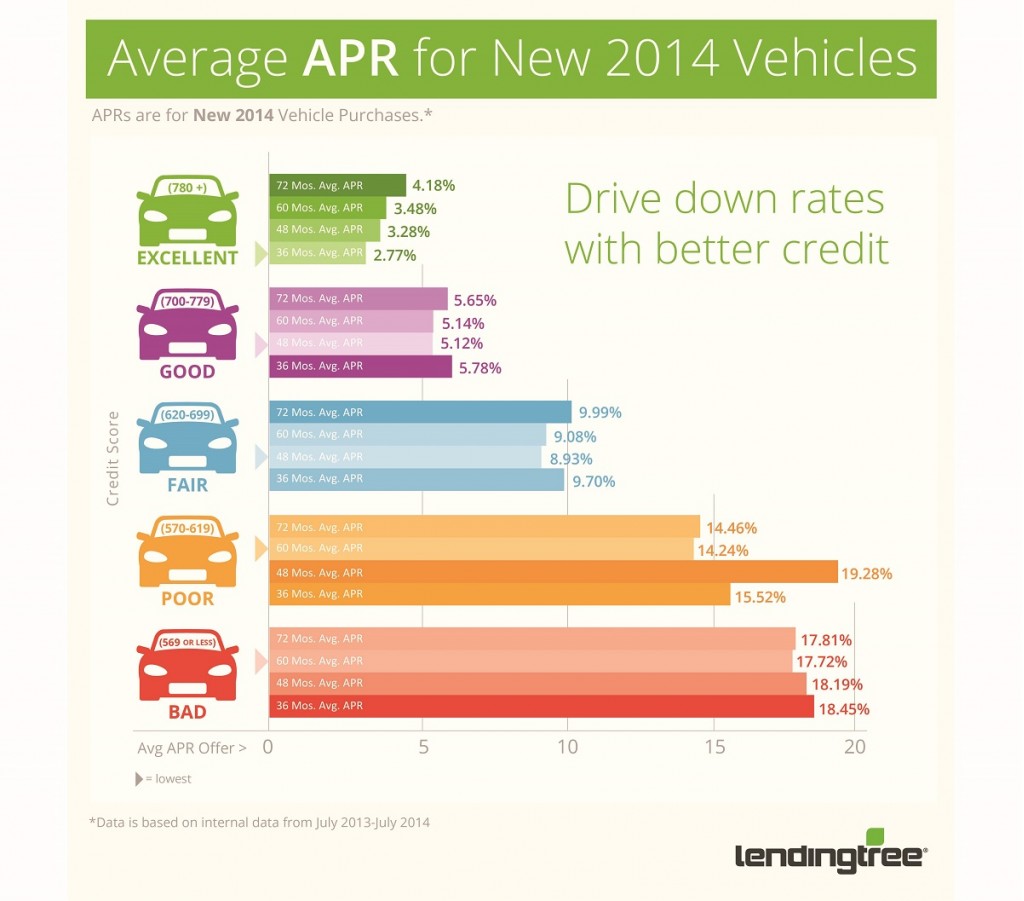

Your Credit Score Your Auto Loan 4 Things You Can Do To Get A Better Interest Rate

How To Buy A Car With Bad Credit Cargurus

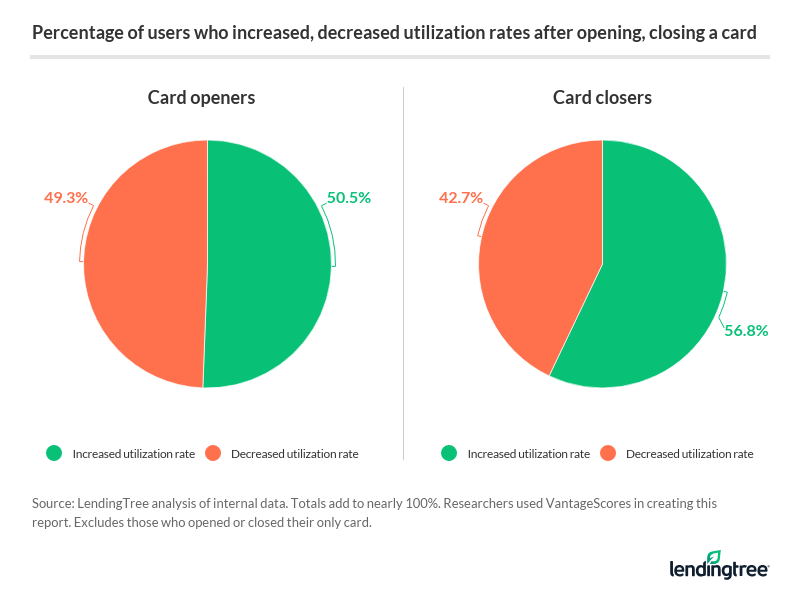

Credit Score Movements When Opening Closing A Card Lendingtree

What Are The Credit Score Requirements For An Auto Loan Credit Sesame

Qod How Much An Excellent Credit Score Saves On 25k Car Loan Blog

What S The Minimum Credit Score For A Car Loan Credit Karma

Why Did Your Credit Score Drop After Paying Off Debt Lexington Law

Where Can I Get My Credit Score Consumer Financial Protection Bureau

How To Get A Car Loan With Bad Credit Credit Karma